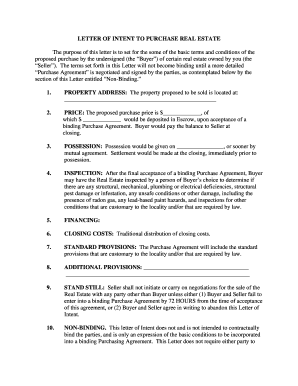

A Letter of Intent LOI template for real estate purchase in Nevada outlines the buyer’s proposed terms. It serves as a preliminary agreement.

A Letter of Intent (LOI) plays a crucial role in the real estate purchase process in Nevada. It sets the groundwork for formal negotiations by detailing the buyer’s proposed terms and conditions. Although not legally binding, an LOI demonstrates the buyer’s genuine interest.

This document typically covers key aspects such as purchase price, deposit amount, due diligence period, and closing date. Understanding the importance of a well-drafted LOI can streamline the transaction and avoid potential misunderstandings. For both buyers and sellers, having a clear and concise LOI can facilitate smoother negotiations and set the stage for a successful property purchase.

Key Components

The Loi Template for Real Estate Purchase in Nevada is essential. It outlines the purchase agreement’s fundamental elements. Let’s delve into its key components.

Basic Information

The Basic Information section includes critical details. These are:

- Property Address: The specific location of the property.

- Purchase Price: The agreed amount for the property.

- Deposit Amount: Initial payment made by the buyer.

- Closing Date: Date when the purchase will be completed.

Parties Involved

The Parties Involved section lists all parties. This includes:

- Buyer: The individual or entity purchasing the property.

- Seller: The current owner of the property.

- Real Estate Agents: Professionals representing the buyer and seller.

- Attorneys: Legal representatives for both parties.

Each party’s role and contact details are crucial. This ensures smooth communication throughout the process.

Credit: www.pdffiller.com

Financial Terms

The financial terms of a Loi Template for Real Estate Purchase in Nevada are crucial. They define the money-related aspects of the deal. Understanding these terms can help ensure a smooth transaction.

Purchase Price

The purchase price is the total amount the buyer agrees to pay. This amount can include the cost of the property and any additional fees. It’s essential to agree on this amount upfront.

The purchase price might be subject to negotiations. Both parties should be clear on the final agreed amount. A table can help outline the components of the purchase price:

| Component | Amount |

|---|---|

| Base Property Cost | $300,000 |

| Additional Fees | $10,000 |

| Total Purchase Price | $310,000 |

Financing Options

Various financing options are available for real estate purchases in Nevada. Choosing the right option can make a big difference.

- Conventional Loans: These loans are not insured by the government.

- FHA Loans: These are backed by the Federal Housing Administration.

- VA Loans: Available to veterans and are backed by the Department of Veterans Affairs.

- Cash Payments: Paying the full amount without a loan.

Each financing option has its benefits and drawbacks. Buyers should consider their financial situation before making a choice.

Property Details

The Property Details section in a Loi Template for Real Estate Purchase in Nevada provides crucial information. It helps buyers understand key aspects of the property they are interested in. This section is vital for transparency and ensuring a smooth transaction.

Description

The Description part outlines the property’s main features. It includes details such as:

- Location: Exact address and neighborhood

- Size: Square footage of the property

- Type: Single-family home, condo, etc.

- Rooms: Number of bedrooms and bathrooms

- Outdoor space: Details of yard, garden, or balcony

Providing a clear description helps buyers visualize the property. It sets expectations right from the start.

Condition

The Condition section highlights the current state of the property. It includes:

| Aspect | Details |

|---|---|

| Overall Condition | New, good, fair, or needs renovation |

| Recent Upgrades | Any recent renovations or repairs |

| Appliances | Condition of kitchen and laundry appliances |

| Structural Integrity | State of the foundation, roof, and walls |

| Utilities | Condition of plumbing, electrical, and HVAC systems |

Clearly stating the property’s condition builds trust. It allows buyers to make informed decisions.

Credit: legaltemplates.net

Contingencies

Contingencies are crucial in a real estate purchase agreement. They provide essential protections for both buyers and sellers. In Nevada, these contingencies can make or break a deal. Understanding them ensures a smooth transaction.

Inspection

An inspection contingency allows the buyer to hire a professional inspector. The inspector evaluates the property’s condition. This includes the structure, plumbing, electrical systems, and more. The buyer can negotiate repairs or cancel the deal if issues arise.

Key points of an inspection contingency:

- Time frame for the inspection

- Scope of the inspection

- Options for addressing inspection results

Appraisal

An appraisal contingency ensures the property is valued at the purchase price or higher. A licensed appraiser assesses the home’s market value. If the appraisal comes in low, the buyer can renegotiate or walk away.

Key points of an appraisal contingency:

- Time frame for the appraisal

- Impact of a low appraisal

- Renegotiation options

Closing Process

The closing process in a real estate purchase in Nevada is a crucial step. It involves finalizing the transaction and transferring property ownership. Understanding this process ensures a smooth transition for both parties.

Timeline

The timeline for closing can vary. Typically, it takes about 30 to 45 days from the acceptance of the offer. This period allows for all necessary checks and balances to be completed.

Here is a standard timeline outline:

| Day | Activity |

|---|---|

| 1-5 | Acceptance of Offer |

| 6-10 | Inspection Period |

| 11-20 | Appraisal and Financing |

| 21-30 | Final Walkthrough |

| 31-45 | Closing Day |

Required Documents

For a successful closing, certain documents are essential. Ensure all parties have these documents ready to avoid delays.

Here is a list of required documents:

- Purchase Agreement

- Title Deed

- Home Inspection Report

- Appraisal Report

- Mortgage Documents

- Proof of Insurance

- ID Proof (Driver’s License or Passport)

Having these documents organized helps in a smooth closing process.

Credit: www.uslegalforms.com

Legal Considerations

When creating a Letter of Intent LOI template for real estate purchase in Nevada, understanding the legal considerations is crucial. This ensures compliance with state laws and protects both parties involved. The following sections highlight key legal aspects to consider.

Nevada Laws

Nevada real estate laws govern property transactions. These laws cover contracts, disclosures, and ownership rights. Ensure the LOI complies with these regulations.

Key aspects include:

- Disclosure requirements: Sellers must disclose property defects.

- Contract law: The LOI must meet contract formation requirements.

- Escrow arrangements: Details of escrow procedures should be clear.

Consult a real estate attorney to ensure all legal aspects are covered.

Dispute Resolution

Dispute resolution clauses in the LOI are essential. They outline how conflicts will be handled. This saves time and money in case of disagreements.

Common methods include:

- Mediation: A neutral third party helps resolve disputes.

- Arbitration: A binding decision is made by an arbitrator.

- Litigation: Disputes are resolved in court.

Choose the method that suits both parties. Clearly outline it in the LOI.

For more complex transactions, consider including a detailed arbitration clause. This ensures a quick and binding resolution.

Tips For Buyers

Buying real estate in Nevada? The Loi Template can help. Follow these tips for a smooth purchase process. Learn effective negotiation strategies and due diligence steps.

Negotiation Strategies

Strong negotiation skills can save you money. Here are some tips:

- Research the market: Know the current market trends.

- Understand the seller’s motivation: This can give you an edge.

- Start with a fair offer: Avoid lowball offers.

- Be ready to walk away: This shows you are serious.

Negotiation isn’t just about price. Consider other factors too:

- Closing date

- Repairs needed

- Inclusions like appliances

Due Diligence

Thorough due diligence protects your investment. Follow these steps:

- Home Inspection: Hire a qualified inspector. Check for hidden issues.

- Title Search: Ensure the title is clear. No liens or disputes.

- Review HOA Rules: Understand the Homeowners Association rules.

- Environmental Checks: Check for environmental hazards.

Always review the LOI carefully. Make sure it meets your needs.

| Due Diligence Step | Importance |

|---|---|

| Home Inspection | High |

| Title Search | High |

| Review HOA Rules | Medium |

| Environmental Checks | High |

Common Mistakes

Using a Letter of Intent LOI template for real estate purchase in Nevada can be complex. Many people make common mistakes that can cost time and money. Understanding these errors helps you avoid them.

Avoiding Pitfalls

Some pitfalls are easy to avoid with the right knowledge. Make sure all terms are clearly defined in the LOI. Undefined terms can lead to misunderstandings.

Always include a specific timeline. A missing timeline can delay the process. Both parties should agree on the timeline.

Ensure the LOI is not legally binding. Clearly state that the LOI is a preliminary document. This avoids unwanted legal issues.

Double-check all financial terms. Misunderstanding financial terms can lead to disputes. Both parties should review and agree on all figures.

Real-life Examples

Here are some real-life examples to illustrate these points:

| Scenario | Common Mistake | Outcome |

|---|---|---|

| Undefined Terms | Terms like “closing date” not specified | Leads to confusion and delays |

| Missing Timeline | No deadline for due diligence | Process takes longer than expected |

| Legally Binding LOI | LOI seen as a final agreement | Causes legal complications |

| Financial Terms | Incorrect total purchase price | Disputes over final payment |

- Undefined Terms: Always define every term in the LOI.

- Missing Timeline: Include specific deadlines.

- Legally Binding LOI: State clearly that the LOI is not binding.

- Financial Terms: Double-check all financial numbers.

Conclusion

Crafting a solid LOI template for real estate purchase in Nevada can simplify transactions. It ensures clarity and transparency. This guide aims to help you navigate the process efficiently. Utilizing a well-prepared LOI can save time and prevent misunderstandings. Your real estate journey in Nevada will be smoother with a reliable LOI.