The value of your ownership is determined by other factors, such as your business exposure and income. These cost estimates are made by selling owners policies to insurance customers.

What coverage and pricing options are available for real estate agent insurance?

We offer every package to the customer in such a way that you can get the coverage of your choice. You pay for what you actually need.

Real estate agent business owners similar to you purchase this coverage combination typically in their package:

- Professional liability – can help protect you when a client has claimed that you have made a professional error

- Workers compensation – can help protect you as your employee has had a workplace injury or work-related illness.

- Business property – can help protect you if you rent out the home or own the building yourself

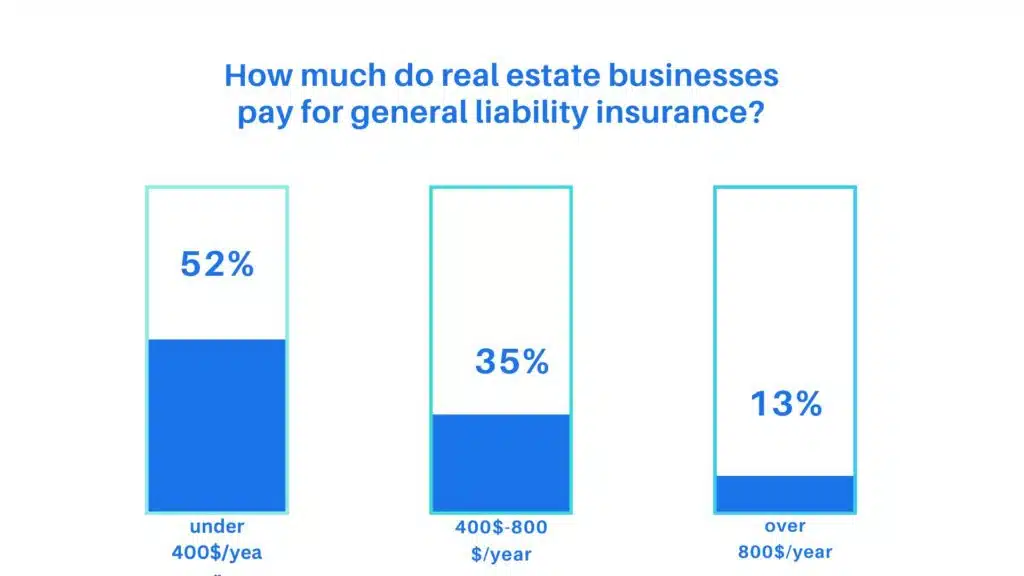

How much general liability insurance costs for realtors

For general liability insurance, real estate businesses pay a median premium of around $30 per month, or $390 per year.According to licensed agents with good real estate insurers, you should consider a business owner’s policy instead of a stand-alone general liability policy.

It is a BOP: it combines general liability insurance with commercial property insurance to provide safeguard for your real estate business at a lower cost than you would pay purchasing each policy separately.

Your amount of risk influences general liability expenses.

Insureon is one of the top 3 online agencies for small business insurance.Based on real estate businesses that are taking general liability insurance covers with Insureon, 52% of them pay $400 or less yearly and 35% pays around $400 to $800 per year.

The cost of general liability insurance varies with the size of your business and the risks it is exposed to.

Common general liability limitations for real estate companies

Savings and eligibility also rest on the specific terms of the policy. A more complicated condition is the policy limit that dictates how much money your authority has to pay for a claim. A per-occurrence limit is for a single claim of your owner and you will pay your account.

9 out of 10 89% of all real estate businesses choose general liability policies with $1 million per-occurrence limits and $2 million aggregate limits. As your small business grows, make sure you increase the policy limits.

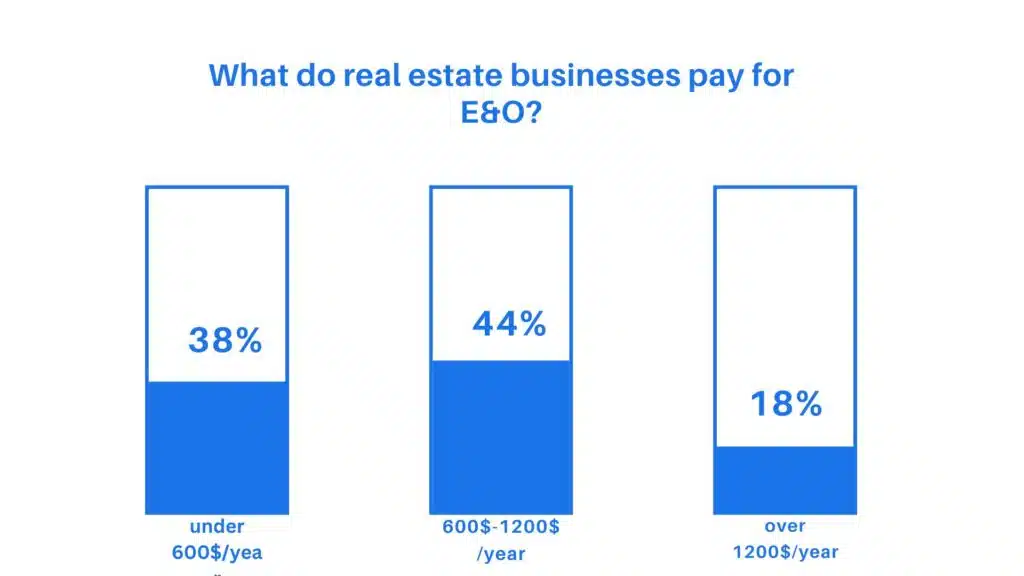

Costs of real estate professional liability errors and omissions insurance

The median price of errors and omissions insurance for real estate businesses is around $55 per month or $665 per year. This policy covers expenses if your business makes mistakes during operation that harm your clients. Sometimes known as professional liability insurance.

The total cost of E&O insurance depends on your risk

Surveys of real estate businesses obtaining E&O coverage from small real estate business insurance show that 38% of clients pay less than $600 per year, while 44% pay between $600 and $1,200. Costs depend on the type of real estate business you have and other important work variables.

What errors and omissions insurance limits do real estate companies typically choose?

Most real estate businesses (61%) take a $1 million per occurrence and a $1 million aggregate limit errors and omissions policy. Another 26% choose policies with a $500,000 per-occurrence limit and a $500,000 automobile aggregate limit.

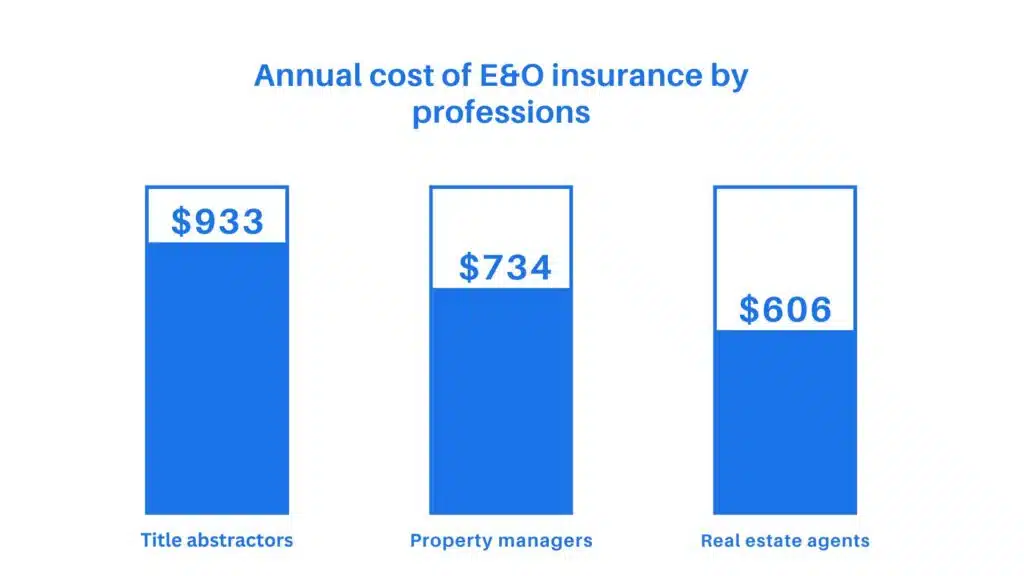

The cost of an E&O coverage is impacted by the professional risks that are involved.

In professions where operator mistakes can result in a catastrophic financial loss to a client, such as a title abstractor failing to spot a propertys zoning limitation, will pay more for this policy. Costs vary widely among real estate professionals.

Just to give you an idea: the typical annual premium for a title abstractor is $933, while the median premium for a real estate agent is $606 – the equivalent of about $50 per month.

How much does real estate insurance cost professionals insurance for worker's compensation insurance?

Real estate businesses typically pay a median premium of about $50 per month or $620 per year for workers’ compensation insurance. This policy helps partially cover medical bills and lost earnings if an employee is injured or ill as a result of an on-the-job injury.

This policy is purchased by real estate businesses with employees who must buy it to meet state requirements and avoid penalties.

When it comes to financial protection against work accidents, sole proprietors can also choose to get workers’ compensation insurance. This is something that their health insurance may not cover.

Workers' compensation expenses are proportional to the number of workers.

The average workers’ compensation insurance costs for real estate businesses are as follows: 31% pay under $400 per year, and 75% pay under $800 per year, the cost among others depending on the number of employees and the hazardousness of their jobs.

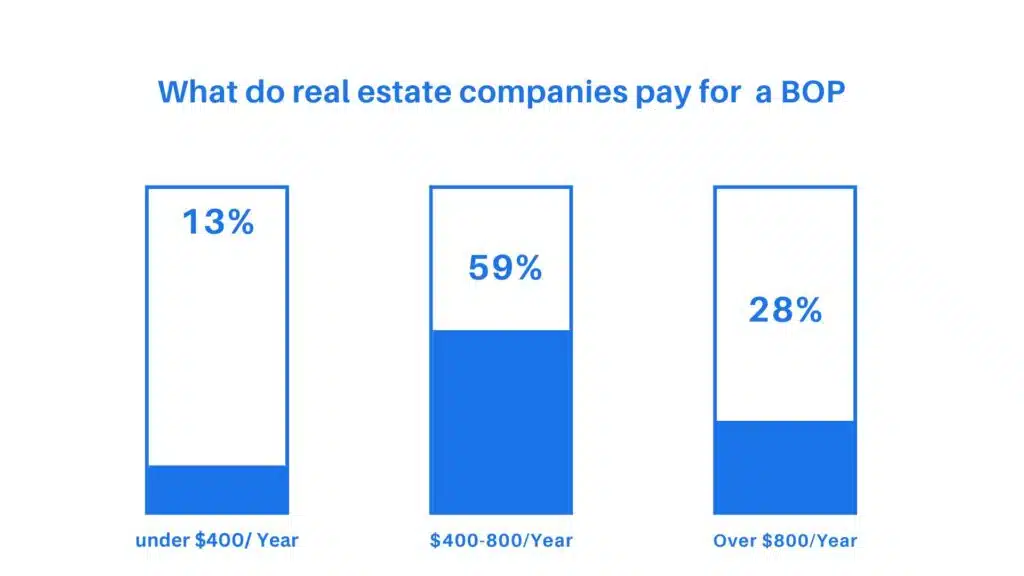

Costs associated with company owner's policies for real estate companies.

Business owners can expect to pay a median premium of under $45 per month, or $520 per year, for a BOP. A BOP is a type of bundled policy that includes the following two policies:

- A business owner’s insurance, which provides liability against third-party injuries and property harm and damage to your business property.

- Commercial property insurance, which protects your owned or rented real estate and its property composition.

Due to its enhanced coverage and cost, Licensed agents usually suggest the BOP.

The value of a BOP is determined by the assets your company owns.

For real estate insurance purchases, 13% of small businesses with small businesses purchase a business owner policy under $400 per year and 59% between $400 and $800 per year.

Business owner's insurance coverage limitations for companies involved in real estate

Source document: Most real estate businesses (79%) choose a business owner’s policy with a $1 million per-occurrence limit and a $2 million aggregate limit.

The expenses of commercial auto insurance for those working in the real estate industry

Small businesses typically spend a median premium of $142 per month or $1,704 per year for commercial auto insurance. State law in most states requires all business-owned vehicles to have this coverage.

The car’s worth determines the policy’s price and how frequently it is used.

Costs associated with cyber insurance for real estate workers

A small business pays a median of $140 per month, which translates to $1,675 each year for cyber liability insurance. This policy’s costs are pegged to how much sensitive information your agency deals with and how many workers can access it.

Cyber liability insurance pays expenses related to a data breach or cyberattack. This type of policy is vital for any real estate professional who processes credit cards or conducts business on the internet.